India – Australia Trade: Prospects and Challenges

Faculty Contributor : Rupa Chanda, Professor

Student Contributors : Nazeer Ahamed Kutty and Roshan Prabhakar

A feasibility study conducted recently by India and Australia has indicated that a Free Trade Agreement (FTA) would be in the interest of both the countries. In view of these recent developments, this article analyses the trade between the countries using a novel framework based on Revealed Comparative Advantage (RCA). The article concludes that FTA could possibly initially increase the trade imbalance in Australia’s favour, but in the long term it would be beneficial to India not only to increase trade but also in gaining expertise in few key sectors and access to hitherto less explored eastern markets.

Introduction

The tremendous economic advancement of India in the recent past has resulted in expanding global trade relations with the countries of the world. The Australian market is one of strategic importance to India as it provides an avenue to establish a foothold in the emerging East-Asian markets. Therefore this has become an important component of India’s strategic economic priorities as part of its look east policy.1

As a step to further develop the growing ties, Australia and India decided in 2007 to undertake a feasibility study to ascertain the potential of a possible bilateral FTA. The feasibility study recommended that the two countries go ahead with a comprehensive bilateral FTA.2 In this context it is important to identify the specific categories which have a potential to enhance the trade relationship and also understand the trade barriers that are affecting the trade between the countries.

Bilateral Trade between India and Australia

The structure of the Indian economy has undergone a significant change in last two decades with services contributing more than 50% of the GDP.3 The Indian growth story has been led by the services sector unlike most other economies which have followed a manufacturing led development. Consequently India’s exports have primarily been dominated by raw materials and other labour intensive categories such as mineral fuels and precious stones. Australian economy, similar to most other advanced economies, has been dominated by the services sector which contributes around 70% to the GDP. However, mining industry still remains a significant contributor to the country’s economy.

In the last few years, the India-Australia trade relations have witnessed a tremendous growth. The bilateral trade increased by 24% annually during the period 2003-04 to 2008-09 reaching US$16 billion and trade in goods crossing US$13 billon.4 However, the growth in trade between the countries has been highly uneven in Australia’s favour. Exhibit 1 indicates that India’s import from Australia is about 15 times its export to Australia.5

Exhibit 1 India’s bilateral trade in goods with Australia (in USD ‘000)

Exhibit 1 India’s bilateral trade in goods with Australia (in USD ‘000)

India’s demand for raw materials and intermediate goods has contributed significantly to this growth in bilateral trade. Indian imports from Australia grew by a CAGR of over 32% during the period 2001-09 while the export to Australia grew at a rate of only 17%. This has resulted in a huge trade deficit for India vis-ŕ-vis Australia.

Analysis of Bilateral Trade

We have analysed the bilateral trade between India and Australia using a novel framework based on a well-known trade statistic known as Revealed Comparative Advantage (RCA) developed by Bela Balassa.6 We have used the framework to identify export categories for India and Australia which deserve attention.

Revealed Comparative Advantage

RCA helps in identifying whether a country has relative export advantage or disadvantage with respect to the rest of the world in a particular category of goods or services.

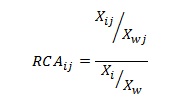

RCA for ith country under jth commodity category RCAij is given by:

Xij is Country i’s exports in category j

Xwj is World exports in category j

Xi is Country i’s total exports

Xw is Total exports of the world

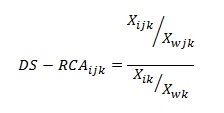

We have developed a slightly tweaked version of RCA called Destination-Specific RCA (DS-RCA) for the purpose of our study. This measure helps in identifying trade competitiveness vis-ŕ-vis the world, for a particular export destination. It is measured by considering the export destination as the market instead of the whole world.

The destination specific RCA for ith country under jth commodity category for destination k, DS-RCAijk is given by:

Xijk is Country i’s exports in category j to country k

Xwjk is World exports in category j to country k

Xik is Country i’s total exports to country k

Xwk is Total exports of the world to country k

The Analysis Framework

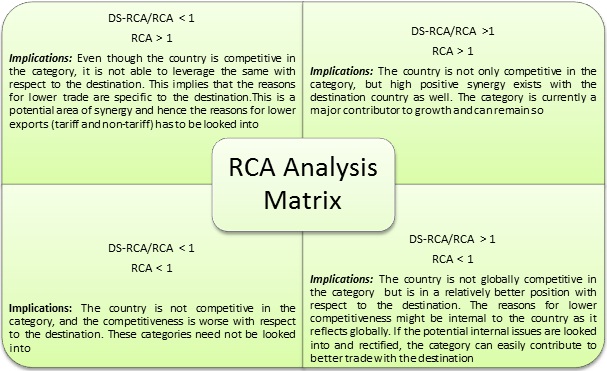

We have used Harmonised System (HS) at level 2 disaggregation for the goods trade categories. After computing RCA and DS-RCA for various trade categories, we have found out the ratio, DS-RCA:RCA. Based on whether the ratio is greater than 1 and whether RCA is greater than 1, we have come up with the analysis framework as shown in Exhibit 2.

Exhibit 2 RCA analysis matrix using the ratio of DS-RCA and RCA

Exhibit 2 RCA analysis matrix using the ratio of DS-RCA and RCA

As can be seen from the exhibit, the categories which deserve attention are those which fall in the top left quadrant of the matrix. These are the categories where the gap will be primarily due to either lack of focus or country-specific tariff or non-tariff issues which can be rectified through an FTA.

Identification of Product Categories

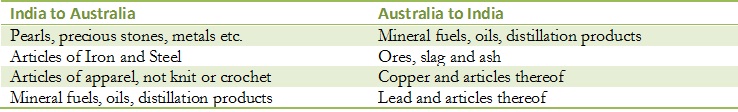

Based on the above analysis, we identified the relevant product categories which are listed in Exhibit 3.

Exhibit 3 List of relevant product categories in India Australia trade

Exhibit 3 List of relevant product categories in India Australia trade

Based on the RCA analysis, the following observations were also made,

-

Even though India’s top exports are highly complementary with Australia’s top imports, relatively low competitiveness in these categories in Australia is contributing to trade imbalance for India. However, many Indian export categories are showing steady growth in RCA over the years analysed (2001-2009) not only globally but also with respect to Australia.

-

Many of Australia’s top exports do not feature in India’s top imports. However, there are key categories like mineral fuels, pearls, precious stones and metals where Australia is highly competitive. As these categories are highly relevant globally, Australia is having high export volumes to India as well. However, for many of Australia’s top exports, the RCA specific to India is growing slowly compared to the global RCA.

Comparative Analysis of India in Australian Foreign Trade

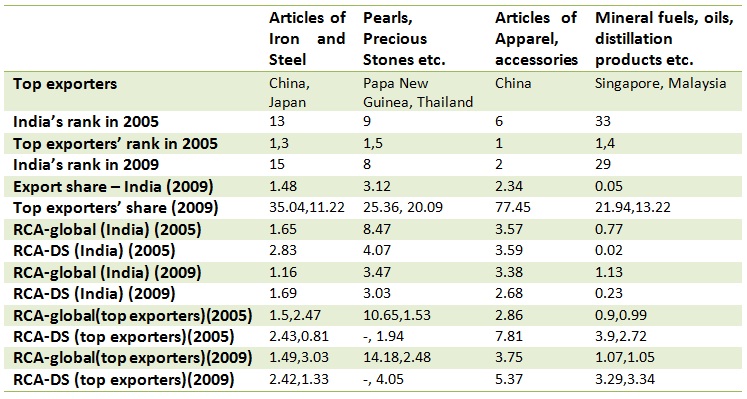

In this section, we explore the competition for India in the export categories identified. We have done comparisons with the top two importers to Australia for the relevant categories. The results are as shown in Exhibit 4.

Exhibit 4 List of relevant product categories in India Australia trade

Exhibit 4 List of relevant product categories in India Australia trade

The common theme that can be observed in all the categories is that India has seen erosion of DS-RCA with respect to Australia in all these categories over the years while the top competitors have improved the same. This may point to a lack of focus exhibited by India towards the eastern markets more than anything else. A case in point is that of apparel trade where China, the top exporter to Australia and India’s nearest competitor has a whopping 77 percentage share with India having a mere 2.34 percentage share. It can also be seen that globally India is neck-to-neck on competitiveness with China while China is far ahead when the market under consideration is Australia. On further exploration of trade data, we found that India’s competitiveness is better in case of markets like Saudi Arabia, Kuwait, Sri Lanka, Myanmar, United Kingdom etc. while it is worse than China in case of Australia, New Zealand, Japan etc.7

Thus, in all the categories identified and specifically in apparel trade, a lack of focus can be one of the contributing factors to low trade competitiveness. An FTA can indirectly help India in this regard by diverting the attention of exporters towards the hitherto ignored geographically distant eastern markets.

Role of FTA in Resolving Trade Barriers

In this section, we look at the barriers in expanding the trade volumes between India and Australia. We would also look at the role FTA can play in resolving the same. The trade barriers can be broadly classified into tariff-based and non-tariff based.

Tariff Barriers

Australia already employs one of the lowest import tariffs globally which stood at an average of 3.1 percentage in 2010.8 Moreover, they have employed unilateral tariff cuts on many product categories. In case of three of the four categories identified for Indian exports, the tariffs faced by India are at par with that of top competitors. The only exception is that of pearls, precious stones etc. where the key competitor Thailand enjoys an FTA with Australia. Thus, contrary to popular beliefs, an FTA may not do much good for India’s exports to Australia. However, the fact that Australia employs comprehensive tariff cuts is encouraging for India. This is well illustrated by the case of Australia-Thailand FTA where tariffs were eliminated on 96% of imports.

At the same time, Australia can gain a lot from FTA as India currently employs relatively high tariff levels. Indian imports have high bound rates close to 50% which creates high uncertainty for importers.9 Thus, all in all, FTA may worsen the trade imbalance for India from a tariff standpoint.

Non-tariff Barriers

The trade barrier reporter database of UNCTAD identifies 25 non-tariff barriers faced by India from Australia of which 32% falls under Sanitary and Phyto-Sanitary (SPS) issues. These issues adversely affect agricultural produce, machinery and most importantly textile exports from India. On closer examination, most of the barriers arise due to mismatches in standards and also due to trivial issues like labelling requirements.

India also employs multiple SPS measures on Australia. A noteworthy case is that of dairy products where Australia is highly competitive and is keen to enter the Indian market. While India imports dairy products from European countries like Italy and Switzerland, it imposes quarantine restrictions on Australia.10 It is viewed that these restrictions are in place to counter the strict SPS norms Australia themselves follow.

Thus, an FTA can play a major role in reducing the non-tariff barriers by introducing Mutual Recognition Agreements (MRA) and thereby eliminating the issues due to mismatches in standards. This can increase Indian textile exports to Australia and Australian agricultural exports to India. As both countries are globally competitive in the respective categories, a MRA can do a world of good.

Conclusion

Our study shows that an FTA with Australia might worsen the trade imbalance if the focus is only on quantifiable steps like tariff reduction. A much more comprehensive treaty which covers issues like standards mismatch etc. especially through Mutual Recognition Agreements and so on would help India beef up its exports and also benefit from Australian imports. This article has not touched upon services trade and investment activities. If these are also looked into, the FTA could certainly help India not just from a trade imbalance point of view but also from a strategic point of view of access to the east.

Keywords

Government, Economics and Social Sciences, India-Australia Trade, Bilateral Trade, Free Trade Agreement, Revealed Comparative Advantage, Look East Policy, Mutual Recognition Agreement

Contributors

Rupa Chanda is a Professor in the Economics & Social Sciences Area at IIM Bangalore. She holds a PhD in Economics from Columbia University with specialisation in International Trade and Macroeconomics. She can be reached at

rupa@iimb.ernet.in.

Nazeer Ahamed Kutty (PGP 2010-12) holds a Bachelor’s degree in Mechanical Engineering from National Institute of Technology Karnataka, Surathkal and can be reached at

nazeer.kutty10@iimb.ernet.in.

Roshan Prabhakar (PGP 2010-12) holds a Bachelor’s degree in Electronics and Electrical engineering from National Institute of Technology, Calicut and can be reached at

roshan.prabhakar10@iimb.ernet.in

References

-

S.D. Muni , 2011, „India’s ‘Look East’ Policy: The Strategic Dimension”, ISAS Working Paper No. 121 – 1 F, Institute of South Asian Studies, National University of Singapore

-

Ministry of Commerce & Industry, Government of India and Department of Foreign Affairs and Trade, Australian Government, 2010, „India and Australia Joint Free Trade Agreement (FTA) Feasibility Study”,

http://commerce.nic.in/publications/Final_JSG_Report_as_printed_and_released_4thMay_2010.pdf?id=18. Last accessed on Aug 8, 2011

-

Central Intelligence Agency website, 2011, „The World Fact Book”,

https://www.cia.gov/library/publications/the-world-factbook/geos/in.html. Last accessed on Aug 8, 2011

-

Ministry of Commerce & Industry, Government of India and Department of Foreign Affairs and Trade, Australian Government, 2010, „India and Australia Joint Free Trade Agreement (FTA) Feasibility Study”,

http://commerce.nic.in/publications/Final_JSG_Report_as_printed_and_released_4thMay_2010.pdf?id=18. Last accessed on Aug 8, 2011

-

International Trade Centre, 2011,

http://www.trademap.org/. Last accessed on Aug 20 2011

-

Balassa, B., 1965, „Trade Liberalisation and Revealed Comparative Advantage”, The Manchester School, pp33, 99-123

-

Authors’ calculations based on data from www.trademap.org

-

World Trade Organization, 2011, “Trade Policy Review of Australia”, Chapter 3, Trade policies and practices by measure, pp31

-

World Trade Organization, 2007, “Trade Policy Review of India”, Chapter 3, Trade policies and practices by measure, pp5

-

Amiti Sen,2008, „Labour-intensive exports to gain from India-Australia trade pact”,

http://www.bilaterals.org/spip.php?article13476. Last accessed on Aug 17, 2011