India-Latin America Trade Relationship

Faculty Contributor : Rupa Chanda, Professor

Student Contributors : Debasmita Panja and Swapneela Biswas

This article explores the opportunities of development of trade shows between India and Latin America in each other’s territories. Latin America, which is valued for textiles, cosmetics, cars and pharmaceuticals and India, known for its specialization in IT, realized that they could successfully utilize their resources by collaboration to improve the economic conditions in both the regions. India signed Preferential Trade Agreement (PTA) with MERCOSUR to improve bilateral trade relations. However, the trade between India and Latin American countries (LAC) is much less as compared to trade between LAC and China. We have analysed trade competitiveness and tariff and non-tariff barriers vis-à-vis China to study the underlying reasons.

Latin America has become a breeding ground for trade and investments across the globe owing to several factors like opening up of economy, reduction of tariff/non-tariff barriers, modernization of infrastructure, privatization and liberalization of financial markets and the establishment of democracy in most parts of the region. Several regional trade arrangements such as MERCOSUR, ANDEAN PACT, CARICOM, etc. have been formed to encourage trade. All these aspects contribute in attracting several economies for enhancing trade and investment relations with Latin America.

Trade and investment relations between India and Latin America have improved over the years. Their economies are greatly complementary with similar demand patterns from their low and middle class income populations. Latin American exporters are focused on exploiting the opportunities of the large and growing market of India. However, India represents just 1 percent of LAC’s overall trade, compared with China’s 10 percent share. So the question which arises is why the commercial relation between the two regions has not increased commensurately? In our research, we have tried to analyze the course of development of trade and investment relationships between India and Latin America over the years, evaluate mutual attractiveness, and assess opportunities, obstacles, possible mitigating solutions to bilateral trade and the future prospects in investment and service sector between the regions.

Overview of Bilateral Trade between India and Latin America

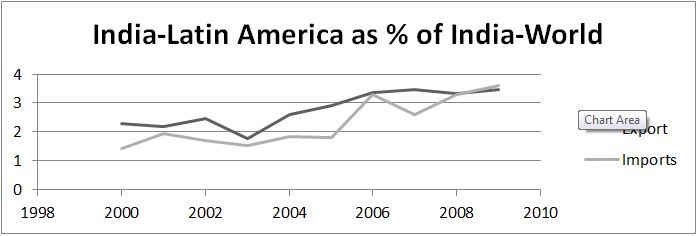

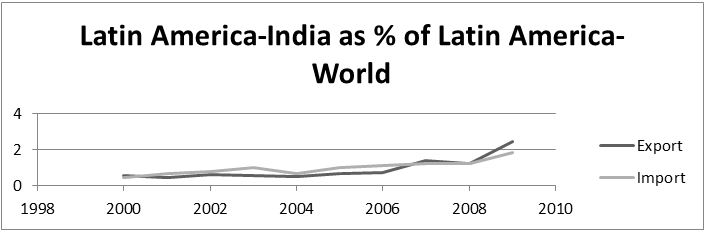

R.Viswanathan, Indian Ambassador to Argentina, Uruguay and Paraguay , in an interview with Financial Express from Buenos Aires, said that, “The new Latin American market has come out of the past curses of instability, unpredictability and cycles of booms and busts. The Indian businessmen need not waste time reading the history of the region and should look at the current and future scenario which is promising”1.Bilateral trade between India and Latin America has changed over the years and has been growing rapidly, registering an increase of approximately 858% in a decade2.Despite the growth opportunities, the bilateral trade is far below its potential. During 2009-10 Latin America had a share of 3.48% in India’s global exports and a share of 3.62% in India’s global imports. Exhibit 1 and Exhibit 2 show the share of bilateral trade as compared to World.

Exhibit 1 Importance of LAC for India

Exhibit 1 Importance of LAC for India

Exhibit 2 Importance of India for LAC

Exhibit 2 Importance of India for LAC

Trade Competitiveness Analysis

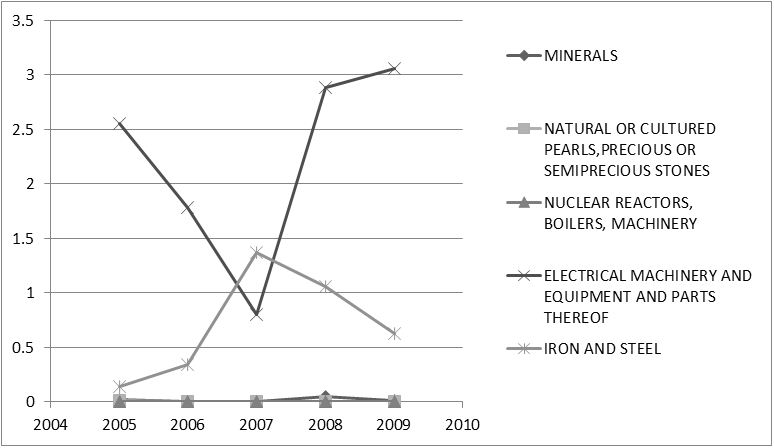

Relative Comparative Advantage (RCA) helps to measure if a country’s comparative advantage for a specific good is revealed vis-à-vis the rest of the world. Whereas, Trade Intensity Index (TII) is a method of measuring and analyzing bilateral trade flows and resistances. We have divided our analysis into two parts: exports from the Mercosur countries to India and India’s exports to the Mercosur countries. Then for each of the part, we have done the analysis for two different set of goods: top 5 importing good of the countries and top 5 bilaterally traded goods. For example, Exhibit 3 shows the TII/RCA graph between India and Argentina for the top 5 imported goods to India from the world.

Exhibit 3 TII/RCA Graph between India and Argentina

Exhibit 3 TII/RCA Graph between India and Argentina

From these analyses, we identified the commodities for which trade competitiveness is decreasing over the years or is presently underperforming. Some of the goods of strategic importance identified are: Minerals, Nuclear Reactors, Chemicals, Vehicles other than Tramway and Railway. One of our observations is, Argentina has less competitive advantage in minerals for bilateral trade with India however we found out that China is a top exporting destination of minerals for Argentina. So we have to discount the distance factor for this good.

Tariff Barriers

Based on the TII and RCA analysis we identified some goods of importance and in those goods we tried to find out tariff and non-tariff barriers. We have taken Argentina and Brazil for further investigation as establishing trade relations with these two countries will open up entry route into Paraguay and Uruguay given the four countries are very well connected through road transport. There have been many formal attempts made to create free trade zones or custom unions within LAC. The role of intra-regional trade in the structural adjustment required by the Latin American debt crisis was important.

We did the tariff analysis for the goods imported to India as India’s import duties are generally higher than other countries. While for the other directional flow i.e. from India to LAC countries, LAC’s import duties are generally less i.e. tariff is not a major issue for unidirectional trade flow from India to LAC countries.

Thus the general observation from analyzing the tariff structures between India and Latin America and comparing that with other countries in the world is that India has high tariff rates not only with Latin America but with other countries as well. This is imposing a barrier to trade with India. However there are several goods like mineral fuels, iron and steel etc. for which tariff rates imposed by India on Latin America are low, yet trade flows in this category from Latin America to India are not gaining momentum. This implies that there must be some reason other than tariff rates which is imposing problems in trade flows. Another observation is that in these categories of goods, tariff rates with China though similar; trade with China is far exceeding trade with India from Latin America. So the next part of our analysis tries to answer these questions by focusing on the following:

-

Whether distance between India and Latin America is acting as a trade barrier?

-

If distance is a factor, then why trade between Latin America and China is huge despite the fact that China and India are at similar distances from Latin America?

Distance as a Non-Tariff Barrier

Geographical distances have impeded trade between India and Latin America. There is no direct shipping service from India to Latin America. Goods have to be shipped to Europe or Singapore which increases freight costs and shipping times. For example, in the case of Brazil, shipping a product from Santos directly to Mumbai would take an estimated 27 days and 15 hours. Shipping via Singapore would take approximately 36 days and 18 hours – almost nine days longer3.Transport costs between India and Latin America seems to act as a significant trade barrier between the regions. Heavy commodities are difficult to trade between such long distances. Due to the long voyage period, perishable gods also cannot be traded.

Comparison with China

According to a Latin Business Chronicle analysis of data from the International Monetary Fund (IMF), Chinese exports to Latin America has increased to $88.3 billion in 2010, by about 62 percent, and imports have increased to $90.3 billion, thus making 42 percent gain4.

China has direct shipping links with Latin America through the Panama Canal. China is planning to build a rail link through Colombia to trade with Latin America thus making it easier for China to export goods through the Americas and import raw materials such as coal and iron ore from Latin American nations. China so as to overcome existing barriers of trade with Latin America has taken an indirect route and adopted strategic moves to increase their trade in the region.

Some of the initiatives that China has taken to increase trade with the region are:

-

China is rivaling with World Bank and Inter-American Development Bank as a major lender to Latin America. Latin America gets trade financing from the Bank of China and investments by the China Investment Corporation. This benefits their co-operation in diverse areas from agriculture to space technology.

-

China has joined the Washington-based IDB with a $350 million loan to develop LAC’s small businesses5.

-

China has signed free trade agreements with Chile, Peru and Costa Rica, for example Chile and China have signed agreements to increase cooperation in mining, banking and telecommunications.

Effectiveness of Trade Initiatives between India and Latin America

MERCOSUR is a conglomeration of four countries - Brazil, Argentina, Paraguay and Uruguay formed in 1991. PTA was signed between India and Latin America on January 25, 2004. India-MERCOSUR PTA came into effect from 1st June, 2009.

Since the PTA is very recent, there has not been any significant effect on trade between the regions.

-

More than half the products covered under MERCOSUR’s offer list come under the category -Organic Chemicals. Most of the subcategories of organic chemicals have a Common External Tariff of 2% to which India has been granted a 10% concession. Probably this being not very significant, it has not impacted the export trends of organic chemicals from India to LAC.

-

We have identified top exports of each of the four countries of MERCOSUR to India. However when we look at the offers list of India in the PTA, it does not feature most of MERCOSUR’s key exports. Items like minerals, iron and steel are showing decreasing trends in competitiveness for export from Argentina to India. Yet they have no presence in the offers list of India. These are potential grounds for improvement for bilateral trade.

-

Considering the exports of India to MERCOSUR, the key complementary products are petroleum and machinery. These categories appear in MERCOSUR’s offer list. Thus this can have a positive impact on trade.

Conclusion

There is huge trade potential between India and LAC bilateral trade as the economies are almost similar. Moreover, LAC can be a potential bypass to enter into US market. Hence, India should identify goods of strategic importance and future negotiations. Distance is a major non-tariff barrier for trade between India and LAC, but China has overcome this factor. India can follow China’s footsteps in taking many strategic initiatives like building shipping link, investing in LAC countries using and offering favourable tariff rates. Building shipping link requires huge investment, but since distance will always be a factor against trade, this investment is highly required. The goods included in the offer list of the preferential agreement between India and Mercosur are not in accordance with the needs of the two countries. This issue should be resolved in future for an effective preferential agreement.

Keywords

Economics, Bilateral Trade, Latin America, MERCOSUR, Relative Comparative Advantage, Trade Intensity, Tariff, Preferential Trade Agreement

Contributors

Rupa Chanda is a Professor in the Economics & Social Sciences Area at IIM Bangalore. She holds a PhD in Economics from Columbia University and a BA in Economics from Harvard University. She can be reached at

rupa@iimb.ernet.in.

Debasmita Panja (PGP 2010-12) holds a Bachelor’s degree in Computer Science and Engineering from Kalyani Govt. Engg. College, West Bengal and can be reached at

debasmita.panja10@iimb.ernet.in.

Swapneela Biswas (PGP 2010-12) (PGP 2010-12) holds a Bachelor’s degree in Information Technology Engineering from Jadavpur University, Kolkata and can be reached at

swapneela.biswas10@iimb.ernet.in

References

-

The Financial Express, 2010, “India-Latin America trade could touch $30 bn by 2012”, Aug 11,

http://www.financialexpress.com/news/indialatin-america-trade-could-touch-30-bn-by-2012/658685/1. Last accessed on Aug 3, 2011.

-

The Hindu, 2011, “India’s engagement with Latin American countries increasing”, May 6,

http://www.thehindu.com/todays-paper/tp-national/article1995504.ece?css=print . Last accessed on Aug 3, 2011.

-

Inter-American Development Bank, 2010, “New IDB study calls for more trade, cooperation between India and Latin America”, Jul 27,

http://www.iadb.org/en/news/webstories/2010-07-27/india-and-latin-america-trade-idb,7480.html. Last accessed on Aug 7, 2011.

-

Latin Business Chronicle, 2011, “China: Latin America trade jumps”, May 09,

http://www.latinbusinesschronicle.com/app/article.aspx?id=4893. Last accessed on Aug 7, 2011.

-

Bloomberg, 2009, “China plans more trade, investment in Latin America, Zhou says”, Mar 28,

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aEK3kCAe9wew&refer=latin_america. Last accessed on Aug 9, 2011.